Oil Market Price War– Australian and Canadian Dollar

Nikolas

Stylianou

16 March 2020

Oil

Market Price War– Australian and Canadian Dollar

Oil price last

week reached its slowest level since the Gulf war of 1991 at almost 27 dollar

per barrel. Oil demand decreased dramatically in short term taking into

consideration that, since the coronavirus outbreak, the oil lost around 30

dollars on its value. Russia resisted and refused to follow O.P.E.C instruction

to cut oil production by 500,000 barrels less per day. Russia is trying to

fight US shale producers and US fracking companies by increasing even more its

oil production rather than cutting it, due to the competition they have with US

in oil supply. By this way they will create a lot of debt to the fracking

companies and will take a toll on US oil exports by increasing their oil

production and at the same time lowering the oil price. Saudi Arabia also

commenced increasing its oil production as Russia did, and both of them have a

lot of billions of oil reserves that can be used later to cover all losing

revenues from now. In the meantime, as per analysts, the oil price it’s

expected to reach 20 dollars per barrel the next couple of days and US shell

companies will be forced to cut production which might generate threats for

bankruptcy. Current oil price is at 26 per barrel. The Australian and Canadian

dollar were impossible to remain unaffected from the Oil trade war. The pairs

depreciated against dollar and closed the week by almost 3%. AUS200 stock index

fell by 3% last week. Both countries Central Banks followed the Fed, proceeded

in cutting their rates by 0.5%. On Thursday, the Bank of Canada said it would

provide billions of dollars of more liquidity and Canadian government bond

yields rose across a steeper yield curve. The Bank of Canada has made an

unexpected rate cut, cutting the central bank’s benchmark interest rate by 50

basis points to 0.75 per cent by the end of the week. It’s expected to see

Aussie dollar recovering amid expectations that the unemployment will decreases

for the last two months.

Foreign

Exchange Currencies – European Stocks – ECB decisions

Last three

week’s euro performance against dollar showed how America stocks market was

affected from the coronavirus. Euro has recovered to approximately 6000 points

in a timeframe of 2 weeks, however last week euro price plunged after the

European Central Bank interest rate decision and measures taken to confront the

coronavirus spread. On Thursday Christine Lagarde announced that the interest

rate will remain unchanged to minus 0.5%, despite market expectation of further

rate cut. The interest rate is already negative, and this was the reason that

ECB did not lower even more the rate as they believe that more rate cut will

not be strong solution. The negative rate is meant to spur banks to loan money

rather than park it at the central bank. As per ECB, the interest rate on the

main refinancing operations and the interest rates on the marginal lending

facility and the deposit facility will remain unchanged at 0.00%, 0.25% and

-0.50% respectively. Another measure that has been taken is that ECB expanded

its asset purchase program by 120 billion by buying corporate bonds to help

businesses. All European stock market fall last week by almost 10%. European

index STOXX600 last week declined by 7%, DAX30, Italy, France and Spain indexes

declined to approximately 9%. According to City A.M. Media Group Italian and

Spanish securities regulators have implemented a ban on the short selling of

more than 100 stocks following record losses. According to FxEmpire, the losses

were also driven in part by a new declaration by the World Health Organization

that coronavirus had reached pandemic levels. The Reserve Bank of New Zealand

cuts key interest rate to 0.25% from 1%. Government plans broad-based economic

stimulus. Negative economic implications of the coronavirus continue to rise,

warranting further monetary stimulus.

US

Stock Markets – Gold and Treasuries Yields

Measures called

circuit breakers approved last week by the Securities and Exchange Commission

(SEC) to curb panic-selling on U.S. stock exchanges. They apply both to broad

market indices such as the S&P 500 and Dow Jones Industrial Index as well

as to individual securities. Circuit breakers function by temporarily halting

trading when prices hit predefined levels, such as a 13% intraday drop for the

stock market. Dow jones dropped by 10%

facing its worst week amid coronavirus threats, and from the fact that Donald

Trump announced the suspension travelling from Europe to US by the following 30

days as a measure to confront the virus. The drop on Dow Jones derived also

from the Boeing manufacturing company of airplanes, which lost almost 13

billion dollars and afterward Trump declared a national emergency. Another

reason that led DJ30 to fall is that the Democrats do not support the payroll

tax cut initially proposed by Donald Trump aiding to confront the virus. CME

Group announced on Wednesday night that it will close its Chicago trading floor

as precaution measure due to coronavirus. Predictions show that we expect

further decline to US market stock, and that indicates that gold price might

continue falling lower due to high risk aversion. This uncertainty lead

investors to sell the precious metals in order to cover their losses from the

stock market. Gold closed by almost 10% lower by the last week and is traded on

1520 dollar per ounce. It’s expected to find lower levels at 1450 per ounce.

Investors expecting further rate cut from the Federal Reserve Bank on Wednesday

March 18 to stimulate the economy. Fed also pumped the market with 1.5 trillion

in order to boost the economy and announce that will purchase around 37 billion

dollars for treasuries in order to help business to borrow money. Meanwhile,

the US Federal Reserve overnight injected US$500 billion into the US banking

system and pledged to add another US$1 trillion. It’s expected to see whether

Fed cut even more the rate, and in that case, gold might go to higher levels as

this indicates buy opportunities for gold investors amid US market short

recovering. Another reason that gold prices went even lower is because bonds

yield. which are the coupons or interest rates of bond rose as bonds prices

falling as stock market falling and investors trying to sell bond and gold

which are save heaven assets. The 10-year Treasury note yield TMUBMUSD10Y,

0.981% was up 10.4 basis points to 0.946%, adding to a weeklong rise of 23.7

basis points, the largest such increase since last September.

Bank

of England Rate decision

Following the

Fed, Bank of England proceeded to cut the base rate from 0.75% to 0.25% in an

emergency response to the “economic shock” of the coronavirus

outbreak. As per MSE news, BoE responses to help and support business and

consumer confidence at a difficult time, to bolster the cash flows of

businesses and households, to reduce the cost and to improve the availability

of finance. Pound/dollar last week fall by almost 3% and pound against euro fell

by 4%. In addition, pound fell after the announcement the UK infections reached

almost 1400.

Asian

Markets

India,

Singapore, Australia, Japan, Thailand, Indonesia and the Philippines are also

in bear markets. Benchmarks in Japan, Thailand and India sank as much as 10%

following Wall Street’s biggest drop since the Black Monday crash of 1987. China

cut the reserve requirement ratio for some banks by 0.5 to 1 percentage point,

effective from 16 March unleashing US$78 billion of liquidity to support the

world’s second largest economy from a deeper slowdown. The Shanghai Composite Index

closed with a weekly loss of 4.9%, Asia-Pacific markets, Tokyo’s Nikkei 225

declined by 7% and Hong Kong Index declined by almost 4%. Safe heaven

instrument JPY weakened last week against euro and dollar. It’s expected to see

further interest rate cut, but it may be deferred to April as there is already

a deeper required rate of return targeted cut in March and predictions shows

that this cut will make the yuan weaker against the dollar and is believed

USD/CNY and USD/CNH could cross 7.0 soon. Although that Asian stocks falling, losses

and infections narrowed in mainland China, where communities are recovering

from the worst of the virus.

Expectations

and Forecast in Asia, US and Europe according to Nomura:

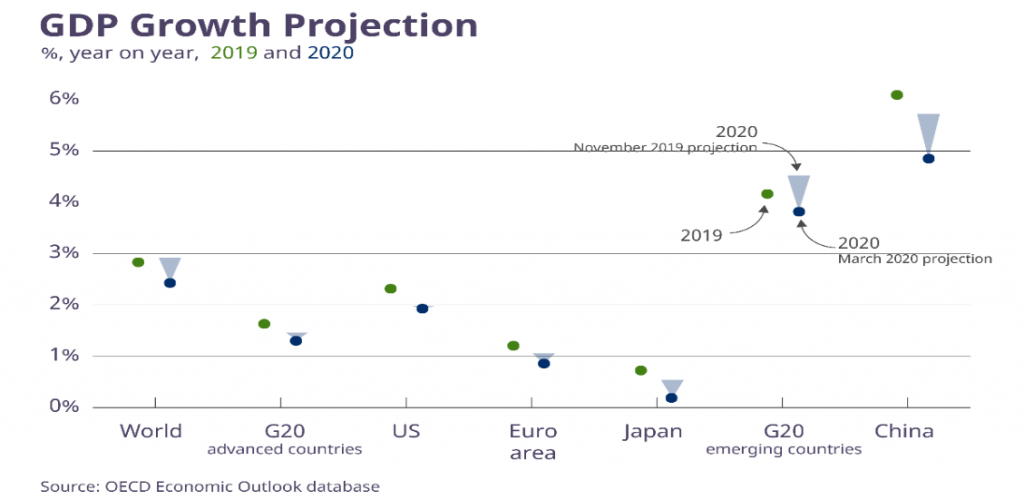

- A new economic-growth estimate

from JPMorgan projects that a recession will hit the US and European economies

by July. - JPMorgan economists now expect

US GDP to shrink by 2% in the first quarter and 3% in the second and Eurozone GDP

could contract by 1.8% and 3.3% over the same periods, the economists said. - It’s expected the Bank of Japan

to decide expansion of ETF purchase in the March Monetary Policy Meeting - The risk is renewed yen

appreciation, caused by concerns over global recession and further rate cuts by

overseas central banks - Lower oil prices are unlikely

to benefit Asia’s growth in the short-term, but they should add to

disinflationary pressures. - Responding to rising risks and

tighter financial conditions, we expect a 100bp cut from the FOMC in March,

reaching the ELB