Daily Market Updates 03.06.2020

Wednesday 03.06.2020

Asian Session

Asian stocks were ready to follow the world rally on Wednesday as hopes for more government incentives, boosted the riskiest assets, and shaded a number of other concerns from the virus in Hong Kong and the growing US civil unrest. Asian stocks rose for third day in a row as service sector returned to growth after survey showed that PMI rose to 55 in May from 44.4 in April Japan’s future index rose by 1.6% in early morning, while Australia’s index went up by 0.58%. Hong Kong index rose by 1.3%, Shanghai index rose by 0.1% and South Korea’s KOSPI index increased by 2.87%.

| Asian Stock | Closed |

| Nikkei | +1.6% |

| Hong Kong HSI | +1.3% |

| China Shanghai SSE | +0.1% |

| KOSPI – South Korea | +2.87% |

US Stocks

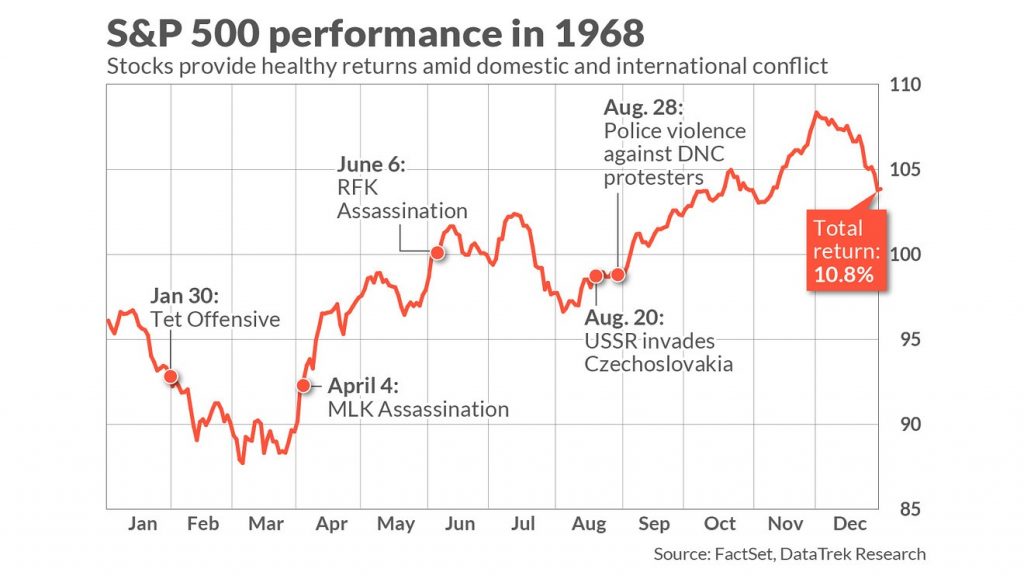

The recent protests within US did not have significant impact to the stock market. Though it seems that factors such as those could influence the equity markets, some analysts said that the improvement in the pandemic health crisis and the global gradual lifting of economic restrictions is enough to support the stock market, that’s the reason why us stock market continue to the upside and investors waiting economy to reopen completely. Dow Jones increased by 1.1%, while SP500 rose by 0.8% and Nasdaq index rose by 0.6%.

| US Stocks | Closed |

| DOW | +1.1% |

| S&P500 | +0.8% |

| NASDAQ | +0.6% |

Major Currencies & Dollar Index

Euro was appreciated even more yesterday against dollar as closed the day with more than 30 pips to the upside, amid expectations that on tomorrow meeting ECB will extend the purchase bond program and will provide more aid to the economy. The pair is currently traded at 1.12 and the 1.146 level now became as the next major resistance level. Pound is appreciated against dollar for fifth consecutive days as dollar remains weaker. The pair course will be affected either positive or negative from the today’s news on UK PMI sector which more probably will confirm the weakness in the sector. The pair is currently traded at 1.26, a great performance for pound from bottom of 1.20 since middle of May. USDJPY rose more than 100 pips yesterday and finally broke above the 108 price level. Next resistance is at 109 level and analysts expect the pair to reach soon that level. The ongoing optimism over the global economic recovery and the aftermath risk-on rally in the equities emerged as the main driver for the recent rally in dollar yen.

Gold Market

Gold prices has a really great performance since March of 2020 and is still up more than 18% from that lows of $1450 per ounce when the stock market crashed, because is deemed as a safe heaven asset, along with the huge amounts of money been provided by Central Banks. Yesterday gold closed negatively and declined almost 1% at $1727 and now is currently traded at 1720. Today gold futures settled down 0.9% at $1734.

Oil Market

Crude oil prices have jumped more than 3% or more than $1 per barrel yesterday on renewed US demand, along with investors hopes that major crude producers amongst OPEC and non-OPEC members will agree by this week to extend oil production cuts. Crude oi l future prices on WTI was settled at $36.8 per barrel yesterday, while future Brent crude oil was settled at $39.5 per barrel.

European Stocks

Some analysts said that the ECB could provide on its Thursday meeting the so-called pandemic emergency purchase program by 500 billion euros, bringing it to 1.25 trillion euros (US$1.4 trillion) and gave a boost yesterday on the stock market. Volkswagen, Daimler and BMW, gained more than 5% on confidence that Germany’s proposed 5-billion-euro stimulus package will boost car sales. Stoxx600 index rose by 1.57%.

On the data front 03-06-2020

| Time (GMT+3) | Event | Impact |

| 12:00 pm | EUR Unemployment Rate (May) | High |

| N/A | USD G7 Call on Coronavirus | High |

| 15:15 pm | USD ADP Employment Change (May) | High |

| 17:00 pm | USD ISM Non-Manufacturing PMI(May) | High |

| 17:00 pm | CAD BoC Rate Statement & Interest Rate Decision | High |