US historic recession it is coming to an end

09-06-2020

Nikolas Stylianou

US markets – US stocks have ignored the recent protests within the country last week and erupted after a black man died last Monday following a confrontation with police. White House did not expect that this fact will cause long term economic implications. While that was happening, many retailers and businesses were still exhausted from the pandemic and were caught up in vandalism. Investors are optimistic about global factory activity along with the retreat of pandemic infections and with additional government stimulus plans and that will go towards recovery, ignoring to some degree the violent protests in US cities. Some analysts said the improvement in the pandemic health crisis and the global gradual lifting of economic restrictions is enough to support the stock market. Additionally, given the fact that airline companies will begin again their operations, this aid stocks index to go even higher. Us stocks rallied to the upside at the beginning of this week pushing Nasdaq to an all-time high and the SP500 into positive track for the current year. The greater than expected Non-Farm Payrolls last Friday have aided the market to become even more optimism for economy recovery. Additionally, stocks rose as drug makers promised in their announcement positive upcoming news for the virus treatment and vaccines. The US economy entered a recession in February as the pandemic hit the nation, a group of economists declared on Monday, ending the longest expansion on record. Employment, income, and spending fell sharply marking the start of the downturn after nearly 11 full years of economic growth. The global economy will shrink by 5.2% this year due to the massive shock of the pandemic and the lockdown measures, the World Bank said on Monday. America’s economy is expected to contract by 6.1% before rebounding in 2021 and employers also reported cutting roughly 22 million jobs in March and April.

Asian – Asian stock market began previous week higher, as the progress on economies opening aid to offset the recent tensions between US and China, as Trump left their trade deal intact. An official Chinese survey showed increase in factory, however with lower pace during May. Investors were mainly focused on past prospects for the deployment of the US military to quell social unrest. There is too much optimism in the market, however big worries are coming from that widespread protests in the US, as they could disrupt the economic recovery and widen the outbreak. More government incentives boosted the riskiest assets, and shaded a number of other concerns from the virus in Hong Kong and the growing US civil unrest. Also, Asian service sector returned to growth after survey showed that PMI rose to 55 in May from 44.4 in April. End of the previous week Trump administration activated again the anti-China moves against companies listed on American indices and Trump threaten to increase the bars for Beijing, however Hong Kong index closed the week higher with more than 700 points. Asian stocks are moving narrowly this week as investors are waiting for more positive news output.

European Markets – European stocks edge higher at the beginning of last week after Chinese data came out with positive economic expansion during May and focus returned to the reopening of the world’s economies at the start of the week. In the automotive sector Volkswagen, Daimler and BMW, gained more than 5% last week on confidence that Germany’s proposed 5-billion-euro stimulus package would boost car sales, and the gains continued after the ECB’s announcement that will expand its pandemic emergency purchase program. ECB’s also achieved to hold down the government bond yields as a result investors turned to stocks rather than to bonds, as European governments extend their plans for fiscal boost. European stocks continued last week outperforming the US stock market and, at the end of the week, the European Central Bank provided on its meeting another 600 billion euros to its Pandemic Emergency Purchase program(PEPP) and noted that the Gross Domestic Product it’s expected to contract by 8.7% this year and may not recover as it was in pre-crisis. European stock market failed to continue the recent gains as data showed that Germany faced 18% contraction in industrial output in April.

Gold Market – Gold prices moved higher at the beginning of last week, after the violent protests in US cities while the country is trying to reopen its economy, along with the uncertain relationships between China and America. Despite the violent protests in US, the stock market was rising and there was an optimism about economy’s recovery and that led gold to lose some gains. Additionally, gold collapsed sharply as investors were mainly focused on central bank intervention and economic recovery as stock market demand increased. The protests can have both positive and negative effects on gold, with lack of physical demand and from the other hand boost the demand for the precious metal. Gold fell from 1740 highs to 1690 per ounce near the end of last week, reaching again that previous psychological support level. According to analysts of Citibank gold may touch 2000 per ounce in third quarter of 2021 and until the end of the year could reach the 1900 price level. ECB’s bond buying program supported gold prices at the end of last week, however gold need to be above 1700 in order to get back his bullish momentum. As global economies commenced recovering gold prices became more vulnerable to new lows, as gold lost almost $100 per ounce the last seven days. In the near-term gold may find support from the US and China trade tensions.

Oil Market – WTI has broken the previous downfall last week at around 35.5 dollars per barrel. Worth noted is that US Oil producers have slushed the output and have cut around 400 billion of dollars from capital spending budgets and the pace of drilling decreased by more than 80% from the peak of the Great American Oil Boom. OPEC was expected to extend the current output oil restrictions for one to three months as Saudi Arabia announced that is willing to extend the supply cut until the end of the year. Crude oil prices have jumped on renewed US demand, along with investors hopes that major crude producers amongst OPEC and non-OPEC members will agree by previous week to extend oil production cuts. Near the end of the previous week, the Energy Information administration has reported weekly declines of less than 2 million barrels for the black gold stockpiles and support oil prices to go even higher. Additionally, another reason oil is rising is that China’s crude imports went up by 13% since April to 11.11 million barrels per day in May. There still a stable recovery in Chinese refinery crude processing rates in recent weeks to warrant higher imports. Oil prices were trading even higher this week touching the level of $40 per barrel, after OPEC decision over the weekend to extend its existing agreement for output cut by 9.7 million per barrel until end of July, and that created stabilization in the market for oil recovery. The agreement is for 100k bpd lower than the prior deal because Mexico will end its supply constraints. It is expected to see short term pullbacks reaching $35 per barrel and, according to UBS, WTI may closed the year around $31 per barrel. Interesting remains that the breakeven point for the most OPEC members ranged at $60 per barrel.

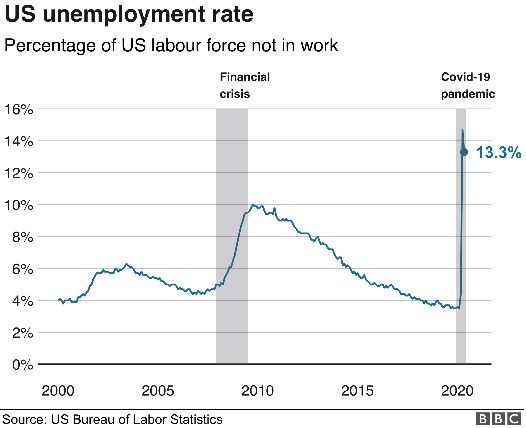

Foreign Currencies – It was obvious that the Euro was showing strong bullish momentum from the commencement of previous week, and this caused optimism for the EU recovery fund along with dollar weakness as protests spread within the country. The worsen than expected PMI news from Germany and Eurozone did not significantly affect the euro price, against its major counter. The selling pressure on dollar remained unbeaten last week and allowed Euro to continue it’s bullish momentum, despite the good US news after the ADP national employment change report showed that the private sector employment declined by 2.76 million in May. Euro went up as a skyrocket last Friday as it gained more than 300 pips and reached 1.136 after ECB’s €600 billion additional stimulus program, and due to that the interest rate in Eurozone remained unchanged. The euro ignored a plunge of 25.8% in German Factory Orders caused due to pandemic crisis, but euro was affected from last week’s NFP which showed positive output for dollar, as US unemployment has dropped from 14.7% to 13.3% for May. Important element is that eurozone’s GDP fell 3.6% and the EU’s 3.2% in the first quarter of 2020, compared to the previous quarter, according to revised Eurostat data. It is the largest loss since records began in 1995. In the fourth quarter of 2019, GDP grew by 0.1% in both the eurozone and the EU. Last Tuesday’s Brexit negotiations between the EU and the British policymakers was a key for the course of pound in the short term. Pound is appreciated against dollar for fifth consecutive days as dollar remains weaker. Pound dollar was affected positively from last week’s news on UK PMI sector which showed better than expected rate at 29.0 as against 27.8 estimated earlier indicating stronger PMI sector. Pound declined later on the week as the BoE Governor Andrew Bailey, told UK Banks to step up plans to leave EU without trade deal. Pound dollar closed slightly above 1.27 level last week. There are worries over hard Brexit, however with worsening US and China relations pound found is finding support. One factor that may pressure the pound is Britain’s slow reopening and the issue with the World Trade Organization that need to be cleared and may still weigh on pound. The fourth round of the EU-UK post-Brexit negotiations ended without any significant progress on key issues and fueled concerns about a no-deal Brexit. Support can be found at 1.2528. The yen sales from beginning of last week after the return of risk sentiment and that fact that Trump left US-China trade deal untouched, as well as Chinese PMI news suggest range trading with upside bias remained. The ongoing optimism over the global economic recovery and the aftermath risk-on rally in the equities along with end of the lockdowns emerged as the main driver for the recent rally in dollar yen. Japan’s GDP was 0.1 lower than expected however this did not significantly affect the yen price. Two last trading days dollar went slightly below 110 level against yen and since then plunged back to 107.9 level. Investors now wait Fed’s decision on Wednesday meeting, however Fed is expected to remain cautious despite recent positive sentiment in the markets, but at least they will not talk about negative interest rates.

Weekly News 08-06-2020 – 12-06-2020

| Time (GMT+3) | Event | Impact |

| 09:00 am 08.06 | EUR Industrial Production (MoM) (Apr) | High |

| 13:00 pm 08.06 | USD OPEC Press Conference | High |

| 16:45 pm 08.06 | EUR ECB’s President Lagarde speech | High |

| 18:45 pm 08.06 | EUR ECB’s President Lagarde speech | High |

| 12:00 pm 09.06 | EUR Gross Domestic Product (QoQ) (Q1) | High |

| 12:00 pm 09.06 | EUR Gross Domestic Product (YoY) (Q1) | High |

| 17:30 pm 09.06 | GBP BoE’s Cunliffe speech | Medium |

| 04:30 am 10.06 | CNY Consumer Price Index (YoY)(May) | High |

| 15:30 pm 10.06 | USD Consumer Price Index ex Food & Energy (YoY)(May) | High |

| 17:30 pm 10.06 | USD EIA Crude Oil Stocks Change (Jun 5) | Medium |

| 21:00 pm 10.06 | USD Fed Interest Rate Decision | High |

| 21:30 pm 10.06 | USD FOMC Press Conference | High |

| 15:30 pm 11.06 | USD Initial Jobless Claims (Jun 5) | High |

| 15:30 pm 11.06 | USD Initial Jobless Claims 4-week average (Jun 5) | Medium |

| 09:00 pm 12.06 | GBP Industrial Production (MoM)(Apr) | High |

| 09:00 pm 12.06 | GBP Gross Domestic Product (MoM)(Apr) | High |

| N/A 12.06 | CNY FDI – Foreign Direct Investment (YTD) (YoY)(May) | Medium |

| 17:00 pm 12.06 | USD Michigan Consumer Sentiment Index (Jun) | High |