How markets will be affected ahead of 2020 US presidential elections

11-09-2020

Nikolas Stylianou

US markets – US stock equities pushed the market even higher to a record-highs from the day the recovery began, as a result the sector was more valuable than the entire European market and reached pre-pandemic levels, however fundamentally this is not true. The total market capitalization of the US technology stock market reached $9.1 trillion, while European, UK and Switzerland market are now worth around $8.9 trillion. US stocks indexes had a great performance during August and with Dow Jones closing the month with more than 2000 points higher. Except the tech stocks that advanced higher, stocks in cruise lines, airlines, hotel, and casino operators have also increased significantly. The Dow rose by 7.6% during August and ended the month down 0.4% for 2020. The Nasdaq Composite was up by 9.6% for August and up 31.2% for the year, while the Nasdaq index rose by 11% for August and up 38.7% for 2020. Shares of Apple and Tesla was the main players with +21.4% and 74.1% respectively for August. Us stock market continue soaring last week with tech stocks continued leading and outperformed on the first day of September month, with Zoom surging by 47% after report came out showing another blowout quarter. Investors are hoping the evolvement of the development of vaccines for Covid-19 along with low interest rates with new Fed dovish policy. Near the end of the week US shares fell with technology stocks and other high-flying stock sectors suffering steep losses and faced their worst day since June. US stocks market started reversing from highs after hitting pre-pandemic levels and many of investors were wondering what is happening with stock market as America is facing significant recession. Bullish investors see the promise of lower interest rates for years to come and further injections of money by the Fed

Asian – Japan’s equities outperformed the stock market beginning of last week, been enhanced by Berkshire Hathaway Inc.’s purchase of stakes in five major trading companies, one of billionaire Warren Buffett’s biggest investments in the nation. Australian shares underperformed the market later in the week, caused by a decline in financials, while South Korea’s share market advanced even higher as the government prepares to boost its budget by next year. Chinese manufacturing indicators provided upbeat mood to investors and created an optimistic economic outlook which recovers abroad. The Caixin China manufacturing purchasing managers’ index, which primarily tracks small manufacturers, rose to 53.1 in August from 52.8, however Asian equities were mixed as investors assessed valuations with global shares at a record high. Additionally, China’s service sector activity remained positive after a report came out last week showing a rate of 54, as compared to July’s rate of 54.1. By end of the week Asian shares fell, along with US equities while Wall Street’s benchmarks posted their biggest declines within a single day for nearly three months as investors concerns about the economy came up. Asian equities began the week mixed, with Hong Kong’s index falling by nearly 0.6% today as SMIC (Semiconductor Manufacturing International Corporation) shares listed plunged around 20%, as Trump may impose restrictions on SMIC exports. Meanwhile a data came out showed China’s dollar-denominated exports rose by 9.5% within a year against minus 2.1% on imports.

European Markets – European equities were set to open higher at the commencement of the previous week as dovish U.S. monetary policy signals enhanced the confidence for a global risk asset. European stocks fell last day of August with Stoxx600 index declining by 0.6% to 366.31, with the German DAX down 0.7 and the French CAC40 down by 1.1%. For the past month, the Stoxx600 is up around 3%. EU stocks closed lower later in the week with Pan-European index retreated for fourth day in a row and tracked its longest losing streak in nearly three months as investors digested corporate news, along with new dovish Fed policy. Additionally, EU stock market affected negatively from the bad Eurozone’s retail sales data, as minus 1.3% reported against 1.5 forecasted. By the end of the week European equities closed by 1.4% lower after increasing more than 1.2% as technology stocks weakened, with the group falling 3.76% in its biggest single day decline since April 21. European equities may rebound this week after falling for two consecutive days last week, as there is uncertainty due to concerns over new coronavirus infections and economic recovery, despite positive data from US and China.

Gold Market – Spot gold price was up by almost 0.4% at $1,971.68 per ounce beginning of last week, before retreated to $1920 price level by the end of the week. However, gold was down nearly 0.2% for the past month as previously reached a high record of $2075 per ounce mid of August. U.S. gold futures rose 0.4% to $1,982.50, as dollar remained weaker due to the Fed policy which noted the interest rates will remain low. Gold prices rose for third consecutive days last week to hit two-week top. Already a month passed since gold reached the all-time high records of $2075 per ounce and found very strong support level around $1850 per ounce. Gold prices dropped as much as 0.35%, as dollar commenced appreciating against its major counters. Investors started selling gold by the end of the week as volume increased by 28.6k contracts and led gold hit almost $1900. Spot gold was up 0.2% at $1,935.50 per ounce in early trading in the beginning of this week, trying to move beyond from a one-week low of $1,916.24 per ounce a level that reached on Friday. Gold on futures markets advanced even higher to $1943 per ounce after bad US data regarding quick economic recovery, along with hopes that lower interest rates would last longer. Interesting is that gold advanced by 28% higher, the greatest performance in the history. According to Credit Swiss, gold is more likely to drop further at a key support level which seen at $1887 as gold is ranging in a consolidation level and the upside target is harder to be reached.

Oil Market – Brent crude climbed to $46.08 a barrel on futures, while WTI was traded at $43.11 a barrel beginning of last week which was 0.3% higher. The highest level that Brent reached since early March was $46.23, while WTI reached the highest level of $43.78. A weaker dollar underpinned oil prices although demand struggled to recover due to coronavirus pandemic and supplies remain in excessive level. Chinese crude oil demand had a significant effect and was one of the most critical pillars in the ongoing recovery in oil markets, especially with the largest oil consumer of all, the US, still struggling to recover from the negative demand implications of the coronavirus economic beat down. Goldman Sachs expects Brent crude to reach $65 a barrel in the third quarter of 2021, although it could end the year lower, at $58 a barrel, according to Goldman Sachs analysts, but taking into consideration that vaccines will be widely available. US crude oil inventories declined for the fifth consecutive week and implied gasoline demand is now within 2.5% of its pre-coronavirus levels and oil price is expected to hit $50 per barrel by the end of the year. The price of WTI crude oil declined even more despite EIA released better-than-expected commercial crude oil inventories data held by firms. Inventories fell by more than 9.36 million barrels before two weeks ago and was better than the 1.8 million that analysts forecasted. Additionally, the American Petroleum Institute (API) showed that oil inventories dropped by more than 2 million barrels. Brent and WTI prices lost over 3% at the end of the week and the drop caused by weak US labour market data from ADP, which showed an increase of 438,000 jobs in contrast to the expected 1.25 million increase.

Foreign Currencies – Terence Wu, FX strategist at OCBC Bank, expected Euro/Dollar to chase the 1.1966 top last week and to find the 1.20, as the pair finally did before Euro plunged after dollar strengthened against its major counters. Euro/Dollar was trading below 1.19 later on the week, around 1.187 off the two-year highs above 1.20. The ECB’s Lane said the exchange rate matters, weighing on the euro. Additionally, Euro drop caused also by German retail sales missed estimates and negatively affected euro as the report showed much worse than expected rate which was minus 0.9%. A stronger domestic currency “will not be nice to exporters in the euro zone,” according to Robert Greil, chief strategist at Merck Finck and with real U.S. interest rates falling, it should move toward its “purchasing power parity” at around $1.25 through the end of next year, Greil said. It is the fourth day in a row that Euro/Dollar is traded neutrally after the dollar appreciated due to Fed policy. The pair is looming within a price range of 1.18-1.184 and keeps its range trade intact below mid-1.1800 despite this week’s German Industrial Production negative data as the report showed 1.2% against forecast of 4.7%. Dollar stabilize in the aftermath of NFP jobs report, amid holiday-thinned light trading. Pound/Dollar trades in eight-month highs, around mid-1.3300s, and last week’s highest level was at 1.3500 area as it was expected. Britain’s Chief Brexit Negotiator David Frost noted that he believes that the UK should leave without a trade deal if Brussels continues to ask that the UK should align with its rules on state aid. Meanwhile, pound seems that was not affected that much by the lack of progress in Brexit talks and largely shrugged off the final UK Manufacturing PMI print, which came in at 55.2 as against the preliminary estimate of 55.3. Governor Andrew Bailey said that the downside risk to forecasts from the coronavirus outbreak is much bigger than for Brexit. Pound/Dollar witnessed some intraday selling pressure during Friday amid concerns over no-deal Brexit, as UK Prime Minister Boris Johnson is expected to say by this week that UK and EU should move on in case no free trade deal agreed before mid of October. The eighth round of Brexit negotiations recommences this week. The pair is currently traded at 1.3226 and it is more likely anticipated that pound will fall further to 1.3165 and even lower, otherwise 1.33 remains strong resistance and 1.35 a psychological level. A drop to the 104.70 region in Dollar/Yen should not be ruled out in the upcoming weeks, as FX Strategists at UOB Group noted, however by the end of the week they noted that a move to 104.7 appears to be losing momentum for the time being as we observe rebound on US equity futures, and a modest pickup in the US bond yields. Yen regained some positive traction at the beginning of last week as dollar retreated due to Fed policy, along with upbeat Chinese PMI report. Economists at MUFG Bank see further Yen strength ahead and they believe that the Dollar/Yen will break below the 100 level. By the end of the week Dollar/Yen advanced higher to 106.2 before retreated back to 106 after the US ADP report which was worse than expected. Yen continue going higher after Fed dovish economic view, along with Abe’s (Japan’s Prime Minister) resignation and the pair is traded at 106.2 this week. The Japanese currency was unable to benefit from another round of US-China tensions. If the pair remains above 106 may lead to 107 as next resistance level.

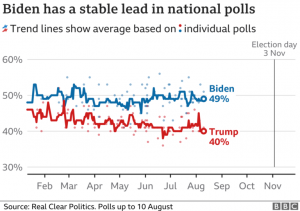

Market ahead of US elections: The 2020 election race between incumbent President Donald Trump and former Vice President Joe Biden is a coin toss, LPL financial chief market strategist Ryan Detrick says. With Trump in the forefront stock market did well enough, as Trump gave incentives to investors to invest in the US stocks market and since the date elected as US President stock market soared, before plunged to a record low. The coronavirus crisis led many investors and portfolio managers to take measures against the devastating development of the market by using credit default swaps which was actually insurance premium paid to cover their risk exposure. Many analysts expect that in the event that Trump re-elected stock market will continue finding new highs, however precious metals and cryptos will expand even higher and more likely gold will surpasses $2500 per ounce. Additionally, dollar will be weaker after elections due to the current monetary policy. On the other hand, if Biden elected as the new president of the country stock market it is more likely to fall and precious metals, along with cryptocurrencies will fall. Recent history shows that election results can have powerful effects on asset prices. Several investors say that the VIX(Volatility Index) could climb further as the election approaches, especially given that certain indicators show a tightening race. Some investors believe that either way markets are more likely to grow more turbulent.