PROFESSIONAL TRADERS

Are you a professional trader? AUSPRIME offers a professional trading account to accommodate your unique needs.

Are you a professional trader? AUSPRIME offers a professional trading account to accommodate your unique needs.

If you satisfy at least 2 of the following criteria, you are eligible for our professional account.

*Financial instruments include shares, derivatives (only cash deposits made to fund/profits realised from investing in derivatives), debt instruments, and cash deposits. It does not include property portfolios, direct commodity ownership, or notional values of leveraged instruments.

AUSPRIME; a prime of prime liquidity provider, is ESMA-regulated, upholding the stringent protocols in the MiFID II Directive. We will undertake a comprehensive assessment of whether you qualify as a Professional Client or an Elective Professional Client. By opting to be a Professional Client, you waive off the highest protection levels and information provision offered to Retail Clients.

As a B2B prime broker, we owe our clients top execution speeds and ensure honesty and transparency in all our dealings. Under Article 27 of the MiFID II Directive, we need to always act in the best interests of clients. But we aren’t required to prioritise overall costs as the most important factor. We might prioritise other factors that we deem more important.

Product restrictions will not be imposed on you. We assume that you have the necessary level of experience and knowledge required to understand the risks associated with trading complex financial products.

The ESMA regulations implemented across the EU from August 01, 2018 have standardised trading norms for retail traders. This includes leverage caps, margin closeout, negative balance protection and restriction on incentives. The leverage restrictions do not apply to professional clients.

| AUSPRIME Professional Clients | |

|---|---|

| Major Currency Pairs | 1:100 |

| Minor Currency Pairs | 1:100 |

| Exotics Currency Pairs | 1:50 |

| Gold | 1:50 |

| Commodities other than Gold | 1:33 |

| Major Indices | 1:25 |

| Cryptocurrencies | 1:5 |

Negative balance protection means that a retail client can never lose more than the total sum invested for trading CFDs. We are not required to offer professional clients negative balance protection. Therefore, should your account fall into negative balance, you are obliged to make additional payments. This means you may incur losses exceeding your deposits.

We assume you have the expertise and knowledge to understand associated market risks. Therefore, you may not be provided additional disclosures that are required to be provided to retail clients. This includes standard risk warnings.

We are committed to communicating with clients clearly and transparently. However, we may use more complex language to communicate with you.

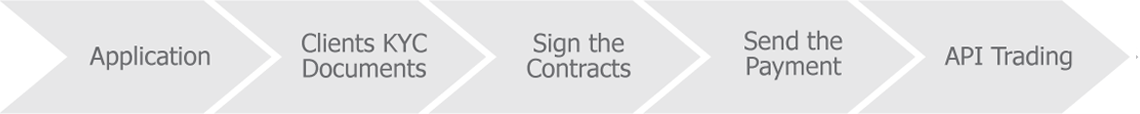

Please send an email to backoffice@ausprime.eu to request the account opening form. This will assist us in opening your account in accordance with the requirements of the Cyprus Securities & Exchange Commission (CySEC). It will also enable us to fulfil the legal obligations of identifying each client under the Cyprus Money Laundering Regulations.

Please send an email to backoffice@ausprime.eu to request the account opening form. This will assist us in opening your account in accordance with the requirements of the Cyprus Securities & Exchange Commission (CySEC). It will also enable us to fulfil the legal obligations of identifying each client under the Cyprus Money Laundering Regulations.

Once we approve the application, you will need to send the following documents.

After the application has been approved and the trading account created, you will be provided with wire instructions for your first deposit.

Once we receive the funds and your account is credited, you will receive credentials for GUI trading or API integration from our back-office team.

Contact us for further information on the registration process.